The U.S. Peripheral Vascular Device Market: Shifting Demographics, Technological Innovation Fueling Growth

By Kamran Zamanian, Ph.D, and Sean Collins, iData Research Inc.

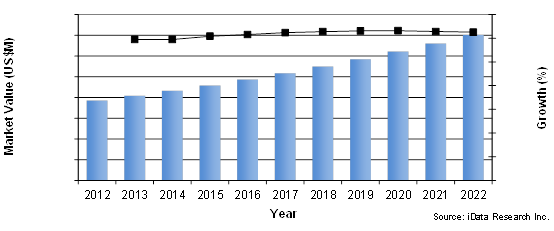

Growth of the United States’ elderly population has driven a steady increase in the number of patients requiring treatment for peripheral vascular lesions. Meanwhile, the availability of increasingly sophisticated technology has improved patient outcomes and broadened the range of patient anatomies that can be endovascularly treated. The subsequent rise in procedural volume has applied upward pressure on the value of the U.S. market for peripheral vascular devices.

Peripheral Vascular Device Market By Segment, U.S., 2012 To 2022

Demographic Shift Increases Treatment Demand

Peripheral arterial disease (PAD) is characterized by the buildup of plaque on the inner walls of the arteries carrying blood from the heart to the legs, arms, stomach, or kidneys. PAD represents a leading source of demand in the U.S. peripheral vascular device market. Roughly 10 million Americans are estimated to be affected by PAD2. The most common endovascular treatments for PAD include stenting, balloon angioplasty, and atherectomy; the combined markets for the devices utilized in peripheral stenting, balloon angioplasty, and atherectomy procedures represented approximately 40 percent of the peripheral vascular device market in 2015.1

The prevalence of PAD increases with age.3 For example, while the prevalence of PAD among individuals age 69 and younger is less than 5 percent, the prevalence of PAD among individuals between the ages of 70 and 79 is roughly 10 percent, and it is greater than 20 percent among individuals over the age of 80.3 The share of the total U.S. population represented by men and women 65 years and older was roughly 15 percent in 2015, and it is expected to reach 21 percent by 2030.4 As the U.S. population ages, the number of Americans with PAD will increase, driving mid-single digit growth in the unit sales of the combined market for stents, percutaneous transluminal angioplasty (PTA) balloon catheters, and atherectomy devices.1

Technological Innovation Drives Unit Sales

Innovative new technologies for the treatment of peripheral vascular lesions are improving patient outcomes and expanding the range of patient anatomies that can be endovascularly treated. The commercialization of recently approved technologies, such as drug-coated balloons (DCBs), and the increasing penetration rate of established, premium-priced technologies, such as detachable coils and stent grafts, will cause the value of the peripheral vascular device market to reach over $7 billion by 2022.

This year (2015) will represent the first full year of DCB sales in the United States. Medtronic’s IN.PACT Admiral Paclitaxel-Coated PTA Balloon Catheter and C.R. Bard’s Lutonix 035 Drug Coated Balloon PTA Catheter (distributed by Boston Scientific) are currently the only DCBs approved by the FDA.5,6,7 Both devices received approval for the treatment of PAD in the superficial femoral and popliteal arteries in late 2014.5,6 Positive results from the DEFINITIVE AR study and favorable reimbursement have resulted in substantial unit sales of DCBs in 2015.1

In the immediate future, double-digit growth in the unit sales of DCBs, combined with relative stability in average selling price (ASP), will drive significant gains in the value of the market for DCBs.1 However, the eventual arrival of additional firms to the U.S. market for DCBs is expected to apply downward pressure on the ASP of DCBs, moderating growth in the value of the market.1 Spectranetics’ Stellarex DCB is expected to be the third DCB to receive FDA approval.1 The company completed enrollment in the ILLUMENATE pivotal clinical study of the Stellarex DCB in July 2015.8 However, the Stellarex DCB is not expected to receive approval until 2017.8

Another key vascularization technology, embolization coils, can be classified as pushable or detachable. The use of detachable coils has increased strongly in recent years, fueled by their ability to be precisely deployed into tortuous anatomies. Detachable coils are sold at a substantial price premium over pushable coils. The high ASP of detachable coils, combined with unit sales growth in the mid-teens, will deliver considerable gains in the value of the detachable coil segment through 2022.1 Strong growth in the value of the detachable coil segment will drive gains in the market shares of companies that specialize in the detachable coil segment of the total embolization coil market, such as Medtronic and Penumbra.1

Abdominal aortic aneurysms (AAAs) can be treated with endovascular stent graft therapy or open surgery. Recent innovations in stent graft technology by Cook Medical, Endologix, Lombard Medical, and TriVascular have expanded the population of patients eligible for endovascular treatment to include patients with short proximal AAA necks, highly angulated AAA necks, and small or diseased access vessels. The availability of a minimally invasive treatment option to patients with AAAs with complex anatomy has driven a decline in the volume of open surgical AAA repair procedures, and caused the market for the surgical grafts utilized in open surgical AAA repair procedures to contract at a compound annual growth rate (CAGR) in the mid-single digits in recent years.1 Further innovation in stent graft technology will continue to expand the spectrum of patient anatomies that physicians are able to treat endovascularly, causing the AAA stent graft market to represent almost 10 percent of the total peripheral vascular device market by 2022.1

Competitive Analysis

Many segments of the peripheral vascular device market showed a low to moderate degree of concentration in 2015.1 However, the atherectomy device, EPD, stent graft, surgical graft, thrombectomy device, and guidewire segments each showed a high degree of concentration.1

Medtronic’s strong presence in the stent, PTA balloon catheter, atherectomy device, chronic total occlusion (CTO) device, stent graft, and transcatheter embolization device segments made them the leading competitor in the total peripheral vascular device market in 2015.1 The company’s overall market share increased significantly following the completion of its Covidien acquisition in January 2015. Medtronic’s overall market share will be buoyed in the coming years by growth in the value of the U.S. markets for DCBs and detachable coils.1

Leading Competitors, Peripheral Vascular Device Market, U.S., 2015

Conclusion

The U.S. market for peripheral vascular devices comprises an extensive portfolio of medical devices designed to treat an array of medical conditions. The prevalence of conditions such as PAD will increase as the U.S. population ages, driving growth in the demand for treatment. Innovations in medical device technology improving patient outcomes and expanding the range of patient anatomies physicians are able to treat will surface to meet the growing demand for treatment. These factors, among others, will combine to drive steady growth in the value of the U.S. market for peripheral vascular devices through 2022.

The information in this article was taken from a global report series entitled Peripheral Vascular Devices Market, covering the following market segments: stents, PTA balloon catheters, atherectomy devices, CTO devices, embolic protection devices (EPDs), stent grafts, surgical grafts, thrombectomy devices, inferior vena cava filters (IVCFs), catheters, guidewires, introducer sheaths, vascular closure devices (VCDs,) and transcatheter embolization devices.

About the Authors

Sean Collins is a research analyst at iData Research and was the lead researcher for the 2016 U.S. Peripheral Vascular Devices Report. He is currently working on a report on the U.S. vascular access devices market, scheduled for release by early 2016.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

Resources

- U.S. Peripheral Vascular Device Market – 2016. iData Research. Accessed November 12, 2015.

- Mohler E. Screening for Peripheral Artery Disease. Circulation. 2012;126(8):e111-e112.

- Mozaffarian D, Benjamin E, Go A, Arnett D, Blaha M, Cushman M et al. Heart Disease and Stroke Statistics--2015 Update: A Report From the American Heart Association. Circulation. 2014;131(4):e29-e322.

- Colby S., Ortman J. Projections of the Size and Composition of the U.S. Population: 2014 to 2060, Current Population Reports [Internet]. Washington, DC: U.S. Census Bureau; 2014 p. 2-4.

- IN.PACT Approval Letter. U.S. Food and Drug Administration Web site. Published December 30, 2014. Accessed November 12, 2015.

- Lutonix Approval Letter. U.S. Food and Drug Administration Web site. Published October 9, 2014. Accessed November 12, 2015.

- Boston Scientific And C. R. Bard Announce Distribution Agreement For Lutonix Drug Coated Balloon. Boston Scientific. Published February 9, 2015. Accessed November 12, 2015.

- Spectranetics Completes Enrollment in ILLUMENATE Pivotal Study. Nasdaq Global Newswire. Published July 29, 2015. Access November 12, 2015.