Medical Device Market In China: Opportunities And Challenges

By Miriam Dabrowa, WILDDESIGN

The stress related to unexpected sickness or hospitalization is always high. It’s even worse if you don’t have any insurance or you have to walk hours or days to the nearest medical facility.

For many years, people in China were deeply concerned about falling ill, as it often led to impoverishment. Since the majority of Chinese citizens didn’t have any insurance until recently, expenses associated with acute or ongoing medical conditions used to devour patient and family savings.

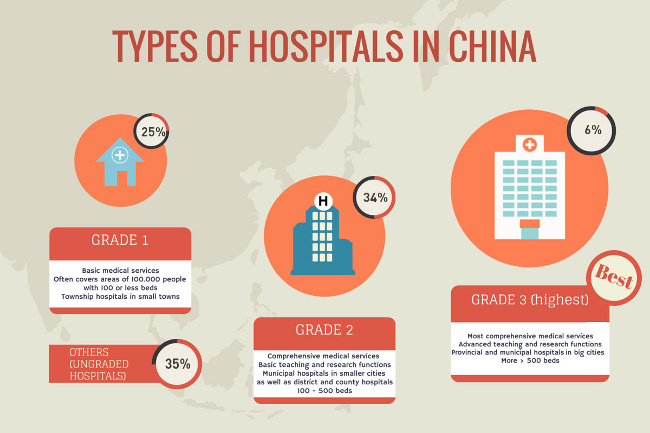

Many financial experts believe that Chinese GDP growth has already reached its peak and predict rather pessimistic forecasts for the Chinese economy. However, this is not the case when it comes to the market for medical devices. The Chinese public healthcare sector, long neglected and suffering from underdevelopment and highly unequal resource distribution, is undergoing massive positive changes. The gap between urban and rural healthcare system — as well as between different classes of hospitals — is still deep, leading to patient frustration and flooding into urban, well-equipped medical centers. By the end of 2014, there were almost 1 million medical and health institutions in China, with many new facilities being built or upgraded.

In this article, we will explore four major opportunities for medical device manufacturers in the burgeoning Chinese medical device market, along with three significant challenges facing companies that choose to pursue the opportunities.

Opportunities

1. Healthcare Reform Started It All

The value of the Chinese medical device market in 2015 has been estimated at about $11 billion, which is still comparatively small compared to the American ($160 billion) and European ($115 billion) markets. One must keep in mind that the Chinese market is still highly underserved, and according to BMI Espicom for the period spanning 2013 to 2018, the annual market growth projection stands at 15.7%. Government healthcare expenses still account for only 5.2% of GDP, and that number will rise in the coming years as the Chinese government aims to bridge the healthcare quality gap and stimulate the domestic market.

The most important factor allowing not only faster development of the Chinese healthcare sector, but also better access to medical care, was the major healthcare reform introduced in 2008. The program was a sine qua non of the Chinese healthcare’s progress. Without going too deep into the details, let’s just review the main goals of this extensive improvement program, which is worth roughly $124 billion:

- Expand basic insurance coverage

- Establish a national essential drug system

- Develop infrastructure for grassroots medical networks

- Provide equal access to basic healthcare services

- Introduce reform of public hospital

Even though many still find the insurance programs offered by the Chinese government rather limited and subject to many conditions, insurance coverage in China skyrocketed from only 30% in 2003 to 95% today.

2. Society Demanding Better And More Sophisticated Healthcare

One of the main challenges for Chinese healthcare is the growing number of senior citizens (people who are 65+ years old), who are expected to account for nearly 25% of the Chinese population in 2050 — up from the current 10%. This demographic change will impose an increasingly serious burden on the healthcare services and pension system. Taking care of the elderly will require significant investment in hospital, medical center, and nursing home equipment.

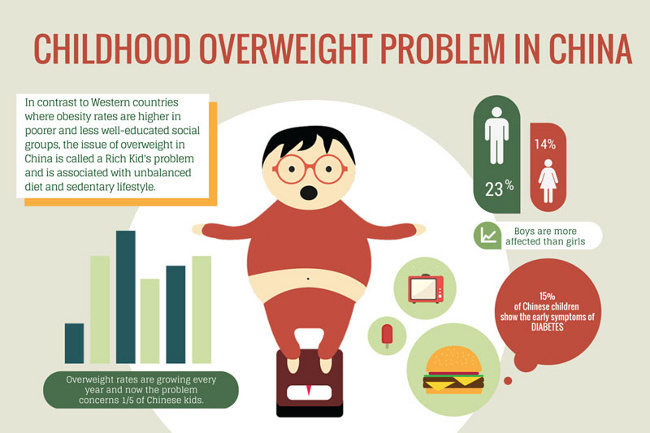

In addition, Chinese society isn’t free from the “diseases of affluence” like diabetes, asthma, high blood pressure, and obesity — resulting from unhealthy lifestyle and environmental pollution.

Plus, the middle class, which now accounts for about 1/3 of the total population, is growing and will drive demand for more advanced and high-quality medical technology, as well as a level of healthcare akin to Western standards.

3. Digital Medicine Soon?

Digital medicine is the next big thing when it comes to the medical device market in China. With the Chinese government encouraging development of medical IT services by creating institutional frames (e.g., last year the National Health and Family Planning Commission of the People’s Republic of China published interpretations and associated guidelines regarding telemedicine services in China), many manufactures already have noted the potential this sector holds.

Major online shopping player Alibaba recently launched an app that enables smartphone users to scan prescriptions and look for the best deals in neighboring pharmacies. Further steps in the development of telemedicine — like enabling online medical consultations — would fill the gaps of medical treatment in the Chinese market. Most importantly, wider implementation of digital medicine would relieve crowded hospitals and doctors, shorten waiting lists, and deliver healthcare services to the most remote areas. Digital medicine in China also includes plans to establish a comprehensive electronic medical record system facilitating patients’ data sharing.

4. High-End Products Will Still Be Imported

Experts say that 70% of advanced medical devices used in China (like Class III devices) are still imported. European, American, and Japanese brands are highly regarded, especially in first-class (Grade 3) and private hospitals. Demand for imported products will rise as lower levels hospitals (Grades 1 and 2) look to improve their equipment.

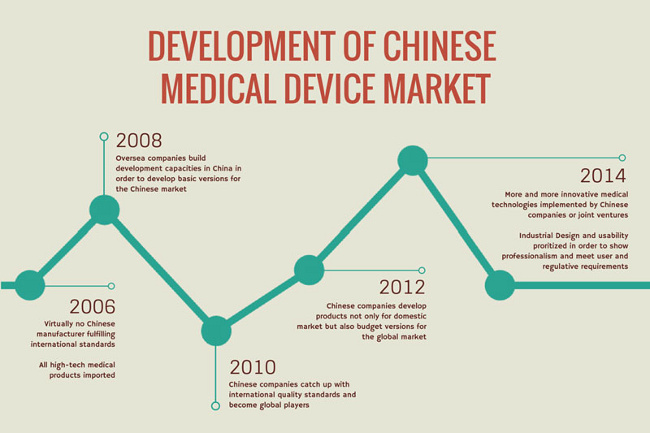

Seven out of the top 10 medical manufacturers in China are foreign or joint ventures companies. Some Chinese manufactures are even eager to move their production abroad, apply for CE Mark approvals, and incur increased production costs in order to place the respected “Made in Germany” tag on final products. However, this opportunity is no longer so certain as a result of the first challenge, which we will now discuss.

Challenges

1. “Buy China” Approach

Chinese hospitals are encouraged to purchase cheaper versions of pricy Western products, unless an expert panel attests that there is no suitable Chinese alternative. In light of increasing healthcare costs, the Chinese government is looking to reduce its healthcare expenses and to stimulate domestic market. The upcoming changes were noticeable, especially when few years ago former President Hu Jintao spoke of the need to “develop advanced medical device R&D and industry” — the first Chinese leader to specifically mention this sector. The government has since announced plans to invest $1.7 million in the medical device sector by 2020.

The quality of domestic production in China has increased over the past few years, and many manufacturers are making significant investments in R&D and developing high-quality products that meet rigorous international standards. (You can see them on display at prominent medical conferences like CMEF in Shanghai or Medica in Dusseldorf. Markus Wild, WILDDESIGN’s founder and director, admits that the Chinese market is changing quickly and that Chinese manufacturers are closing the gap with their Western counterparts.

2. Highly Competitive, Fragmentized Market

The market entry barriers to China’s medical market are comparable to those in other developed countries, with China’s State Food and Drug Administration (SFDA) acting as equivalent of the U.S. FDA. Products that already have FDA or CE Mark approval shouldn’t face too much difficulty when applying for SFDA approval, though the process itself is still said to have too many steps and take too long.

Fierce competition among local manufacturers lowers price and profit margins, often balancing on borderline profitability in hopes of investment from foreign companies. Pricing pressures created by the Chinese government — which imposes price ceilings for tenders and stipulates the sum hospitals can pay for certain types of devices — tend not to consider the R&D costs required to bring a medical device to market. Consequently, if your product is not substantially different from Chinese equivalents, or the advantages offered by your product are not particularly appealing to Chinese medical customers (market research is extremely important), you may want to reconsider entering this market.

Another important requirement for success in China is to build a reliable distribution infrastructure, since conditions, requirements, and demand can vary dramatically depending on the province.

3. Intellectual Property Protection Issues

Although significant improvements in intellectual property (IP) protection have been made in China in recent years, concern over medical device designs being copied by Chinese companies still remains one of the main challenges when entering this market. However, the rising number of patents (in 2014, China topped the international patent application list with whooping 928,000 submissions) and declining incidence of foreign companies involved in IP court cases can definitely be viewed as signs of progress in this area.

Read Part 2 of this article series.