Mayo Clinic LVAD Study Suggests Market Expansion

By Jof Enriquez,

Follow me on Twitter @jofenriq

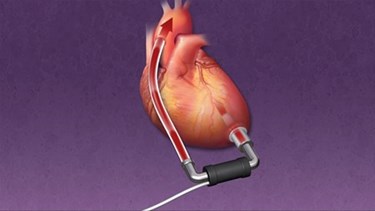

A recent Mayo Clinic study shows improved survival rates in patients with end-stage restrictive cardiomyopathy (RCM) who received left ventricular assist devices (LVADs). The potential to treat more heart failure patients could expand the market for LVADs, which currently are used in the treatment of other types of cardiomyopathy, either as a bridge to transplant (BTT), or as a destination therapy (DT).

Most LVAD clinical trials have focused on end-stage dilated and ischemic cardiomyopathy, and Mayo Clinic researchers wanted to see if LVADs benefited similarly those with advanced restrictive cardiomyopathy, who also face few therapeutic options and a shortage of heart donors. The retrospective study, the largest of its kind, studied 28 patients with end-stage RCM who were transplanted with continuous-flow LVADs from either Thoratec Corporation or HeartWare, Inc. Researchers studied each patient’s baseline characteristics, preoperative data, short-term postoperative outcomes, and long-term post-LVAD complications.

“While other studies have focused on risk factors associated with post-LVAD survival, this is the first study to focus exclusively on end-stage RCM patients and to identify the parameters associated with better outcomes,” says Lyle Joyce, M.D., Ph.D., surgical director of Mayo Clinic’s VAD program, in a news release. “For example, we have defined criteria such as size of the left ventricle which is very important in determining outcome in these patients suggesting that with careful selection we can offer these patients a much better outcome and eventual cardiac transplantation.”

As published in The Journal of Heart and Lung Transplantation, the main findings are:

- LVAD implantation is technically feasible in patients with advanced RCM.

- LVAD therapy is associated with improved survival compared with medical therapy and regardless of RCM etiology.

- LV dimensions are an important predictor for outcome, and LVEDDs <46 mm are associated with significantly increased mortality.

The study authors wrote that, in particular, "a 1-year survival of 64 percent demonstrate[s] that LVAD implantation has a survival benefit compared with the reported natural history of end-stage RCM 1, 2, 3, 4 or to the 1-year survival of 12 percent among RCM patients awaiting transplant while on inotropic support. Our findings are also comparable to the survival data published on end-stage dilated or ischemic cardiomyopathy patients with continuous-flow LVADs in the pivotal multicenter trials showing 68 percent 1-year survival in BTT and DT patients."

The study suggests that, in addition to treating heart failure in dilated and ischemic cardiomyopathy, LVADs also can improve outcomes in RCM, regardless whether the patients receive heart transplants or continue using the devices for long-term therapy.

Approximately 500,000 people currently live with cardiomyopathy, according to figures cited by the Mayo Clinic. Although RCM is a rare form of cardiomyopathy, an additional indication for LVADs could further open up the market.

Thoratec and HeartWare are the main players in the LVAD market, but competing companies include Reliant Heart, Abiomed, Terumo, Sun Medical, and Ventracor.

A report from Companies and Markets predicts that the LVAD market will grow to more than $900 million by 2015, quadrupling from an estimated $237 million market size in 2009. An estimated 100,000 Americans and 150,000 non-Americans will benefit from an LVAD, says the report. In 2011, the penetration level was approximately 2.8 percent in the U.S. and 0.8 percent outside the U.S., and it is forecast to rise as heart failure prevalence increases worldwide.

The growth potential is such that larger manufacturers already are making deals to take advantage. Thoratec, which makes the HeartMate device, is being acquired by St. Jude Medical for $3.4 billion, although a 30-day "go-shop" period allows Thoratec to entertain other buyers, such as Medtronic and Abbott Laboratories, according to the Wall Street Journal.

Also, a dearth of heart donors increasingly is making LVADs destination therapy, rather than a bridge therapy, creating greater demand for these devices. Moreover, researchers believe that advancing LVAD technology eventually will match or surpass clinical outcomes of heart transplants, and may even replace them. At least one study suggests that not only do these devices assist the damaged heart, but they have the ability to regenerate heart cells by reducing oxidative damage.