Implications Of 3D Printing Across The Medtech Value Chain

By James Varelis and Brian S. Williams, PwC

Additive manufacturing, or 3D printing, already has begun to revolutionize how medical devices and other medical products are made, distributed, sold, and used. By printing layers of material on top of one another using a variety of materials, 3D printing allows for the manufacture of products whose forms are more fluid or organic, and whose structural integrity is the same as or greater, than traditional manufactured products.

According to a 2014 PwC survey, one-third of all manufacturers are adopting 3D printing. The medical device industry is no exception. Already, 3D-printed medical products such as customized implants, prosthetics, casts, teeth, and hearing aids are under development or commercially available. The FDA has approved or cleared more than 85 devices made using 3D printers. Where and how is 3D printing changing the medical device industry, and what does the future hold?

Supply Chain

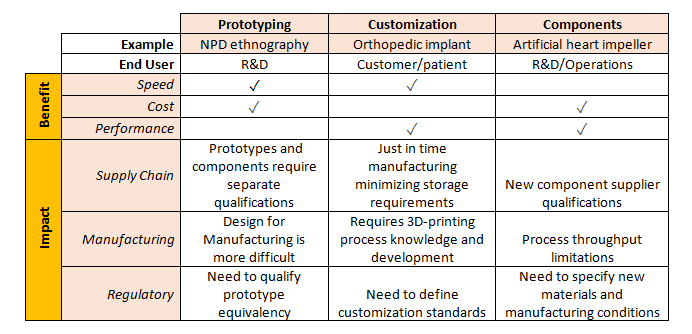

According to a PwC survey, about 30 percent of all manufacturers believe that the greatest disruption from widespread adoption of 3D printing will be the restructuring of supply chains. The potential to shrink the supply chain may be driven by a new approach to inventory – printed parts that currently are produced and warehoused could instead be manufactured where and when they are needed, saving manufacturers the carrying costs of raw materials, work-in-progress and finished goods.[i]

Unlike a traditional manufacturing process configured to create specific components, 3D printers can make a wide range of parts. This flexibility allows supply chain investments to be spread across multiple parts or products. The implementation of customized, just-in-time manufacturing also has profound impacts on supply chain cost structures, enabling manufacturers to provide more useful products without increasing the cost of care.

The need for forward stocking locations may be eliminated entirely, meaning that, while medical device manufacturers may benefit from 3D printing, their distribution partners will face new challenges.

R&D

High-speed, low-cost prototyping[ii] is another opportunity presented by 3D printing, in addition to the chance to design prototypes that use new types of materials, such as a patient’s own cells, incorporated into an implantable device.[iii] Rapid prototyping cuts down on time between design iterations and obviates the need for expensive and time-consuming prototype creation using conventional manufacturing methods, thus giving design engineers and product managers more flexibility and budget to quickly create new devices.

As 3D printing becomes more broadly adopted, the industry value chain may shift. R&D relationships with specialized 3D printing contract manufacturers may play a larger role in enabling the development of scale-efficient printing operations using constantly-improving printing technologies. Through more efficient product development, companies may bring new technologies to the market faster — products that more tightly align with patient-specific conditions and clinician demand for improved outcomes.

Manufacturing

When used to manufacture custom devices, 3D printing’s high speed and high performance outweigh its relatively high cost, producing on-demand, personalized products created in a centralized manufacturing environment. However, while a custom, patient-matched product may better address consumer and clinician needs, it also may present complications when seeking compliance with quality systems. Still, 3D printing enables complex medical device designs with geometries that were previously impossible to manufacture, providing increased performance at a lower cost relative to the next-best alternative, even if the manufacturing speed is relatively slow.

Device manufacturers may be able to capitalize on these opportunities by contracting licensed 3D printers to create their products in hospitals or doctors’ offices. For just-in-time or on-site manufacturing of critical implants or other customized orthopedics, manufacturers may need to establish new norms for pricing structures and value-sharing, since it will require unprecedented levels of training and/or service to support and qualify the products they’ve manufactured in the field.

Customer Impact

The development of patient-matched and custom products with greater precision than ever before — including devices matched more closely to patient specific musculature, vasculature, etc. — can drive improved care outcomes. Enabled by 3D printing, orthopedic implants could be custom-made to personalized specifications, resulting in more precise fit, better outcomes, and higher patient satisfaction, much like how hearing aids currently are customized to a specific ear’s geometry and vasculature. Furthermore, the speed of 3D printing and its potential for aesthetic customization of devices may also prove to be differentiators. Additionally, surgeons may benefit from 3D-printed surgical tools, custom-made to their liking.[iv]

A Transformative Technology

3D printing represents a transformative technology that could fundamentally alter what and how medical devices are designed, manufactured and used. It allows for the novel combination of materials, including human cells, into organic forms that align to patient-specific dimensions and requirements. In addition, 3D printing facilitates the integration of sensors into implants. Integrated sensors enable the development of apps for diagnostic assessment and performance, along with data-sharing, to improve product design and clinical outcomes. Through the creation of customized products, as well as faster development of new products and technologies, 3D printing has the potential to improve product value to the customer through superior patient outcomes.

About The Authors

Jim Varelis is a Principal with PwC's Healthcare Group and leads the Global Medical Technologies Practice. With more than 25 years of industry and consulting experience, Jim has helped large medical device, diagnostic and pharmaceutical companies develop corporate and operational strategies including market entry, expansion, and acquisition strategies, and improve core business processes in innovation, quality, clinical and supply chain operations.

As a director in PwC's New Entrants practice, Brian Williams advises senior executives of traditional medical device and diagnostics companies on the “New Health Economy,” and senior executives at non-traditional healthcare companies seeking to enter and transform access to and adherence to care. He has nearly twenty years of investment, business development and strategy expertise within health care.

References

[i] https://www.pwc.com/us/en/industrial-products/3d-printing-shrinking-the-supply-chain.html

[iv] http://pwchealth.com/cgi-local/hregister.cgi/reg/pwc-hri-3D-printing-FDA-oversight.pdf