Evaluating The Global Markets For Drug-Coated Balloons, Transcatheter Heart Valves

By Dr. Kamran Zamanian, President, and Rami Faour, Analyst, iData Research Inc.

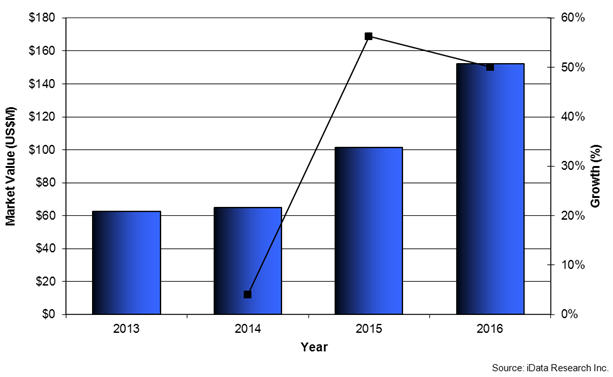

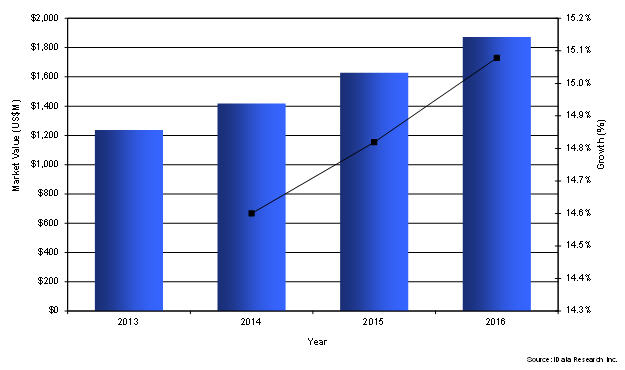

Two of the latest innovations in the cardiovascular medical device markets are drug-eluting balloon angioplasty and transcatheter heart valve implantation (THVI). The market for drug-coated balloons (DCBs), sometimes referred to as drug-eluting balloons, has emerged as one of the fastest growing markets in the peripheral vascular arena, and clinical trials continue to show positive results associated with the use of DCBs. As a result, the global market is expected grow at a CAGR of nearly 25 percent. Similarly, the market for transcatheter aortic valves continues to yield high returns as new clinical results show that transcatheter aortic valves are superior to heart valve surgery. The market is increasingly attracting new competitors and is projected to grow at a CAGR of nearly 15 percent.

Trends And End-User Analysis For Drug-Coated Balloons

Balloon angioplasty is a primary treatment method for treating vessel occlusions that characterize peripheral arterial disease (PAD). By expanding a balloon in the vessel, occlusive deposits are pushed into the vessel wall, reducing blood flow obstruction. These devices’ efficacy is limited by restenosis, the re-narrowing of vessels. Drug-coated balloons have the potential to reduce restenosis rates by releasing anti-proliferative drugs into the vessel wall, thereby minimizing cell proliferation.

The two main positive factors driving growth in the drug-eluting balloon market are: the positive clinical outcomes from the use of drug-eluting balloons compared to uncoated balloons, and the reimbursement policies supporting the use of DCBs adopted in important countries such as Germany. As additional clinical trials are conducted and results are published, it is expected that reimbursement for DCBs will continue to spread in Europe. Moreover, positive clinical data will facilitate FDA approval, which will allow companies to launch DCBs in the lucrative U.S. market.

Global Drug-Coated Balloon Market, 2013-2016 (US$M)

The earliest clinical trials examining drug-eluting balloons for the treatment of SFA lesions were the Local Taxan with short time exposure for reduction of restenosis in distal arteries (THUNDER) and the Femoral Paclitaxel (FemPac) trials, which showed significant reductions in late lumen loss and freedom from revascularization for patients treated with DCB compared to uncoated balloons. These results have been confirmed by more recent trials such as the Superficial Femoral Artery In-Stent Restenosis (FAIR) trial. Drug-eluting stents have also proven to reduce restenosis in SFA lesions. However, a key factor supporting DCB usage among end-users is the benefit of not leaving a metal prosthesis in the vessel, which may lead to thrombosis. Moreover, the design and testing of DCBs must continue to improve in order to demonstrate the efficacy of the devices for longer SFA lesions and for below-the-knee lesions.

The positive clinical outcomes for drug-eluting balloons do not necessarily mean that the adoption will increase immediately, due to the fact that the reimbursement policies do not reflect the benefit of such devices. While the initial costs of placing a drug-eluting balloon are higher than a standard balloon, the reduction in the need for reintervention and follow-up procedures means that hospitals are not reimbursed for these additional procedures. Moreover, the reimbursement rates for standard angioplasty are initially higher for standard balloons when compared to drug-eluting balloons.

Ultimately, the transition to the use of DCBs will depend on clinical outcomes. This is borne out of the developments in the coronary drug-eluting stent market. These devices were introduced in 2003, and they now have captured the majority of the market for coronary stents. The initial adoption was hindered by the same factors limiting the use of DCBs today, including the high cost and lack of reimbursement. However, clinical trials showing a significant reduction of restenosis rates to single-digit levels led to a quick rise in adoption.

A global end-user analysis conducted by iData Research to examine perceptions regarding drug-eluting balloons, suggests that one of the main drawbacks to the use of DCBs is the higher price tag compared to standard balloons. However, the potential in this market has attracted leading companies to make significant investments in the development of DCBs. The intense competition has therefore led to dramatic declines in average selling price (ASP). Moreover, results indicate that end-user preference is divided among the different balloons available.

Additional drawbacks include elastic recoil, which suggests that DCBs will not replace stents but may be used in conjunction with stents. Notwithstanding these limitations, the results suggest that end-user perception of the device is positive, and thus the use of DCBs is set to increase.

Trends And End-User Analysis For Transcatheter Heart Valves

Similar to the trend seen in the DCB market, the transcatheter heart valve market has grown significantly, as physicians utilize this new technology to treat a patient population that previously had no viable treatment options. Transcatheter heart valve implantation (THVI) is a minimally invasive surgical procedure that repairs valve function without removing the patient’s own existing and damaged valve. Currently, there are only transcatheter heart valve (THV) products approved for use on the aortic valve. Such products are transcatheter aortic valve implant (TAVI) devices.

In the realm of cardiology, transcatheter aortic valve implantation has seen increasing interest, and as a result, the global market for TAVI products has grown rapidly over recent years. The TAVI market has not yet reached its full potential, and expectations for growth in this area are high. The adoption of THVI indicated for other valves of the heart is also poised for growth, if and when such products become approved by local regulatory bodies. Results from an end-user analysis conducted by iData Research indicate that the majority of respondents believe that a transcatheter mitral valve implantation device is the preferred valve to be indicated.

Moreover, data shows that the strong growth of THV usage has not come at great expense to the surgical heart valve market. The unit sales of surgical heart valves have remained relatively stable over recent years, while the sale of THVs has grown rapidly. This suggests that THVs have gained access to a patient population while not detracting from those patients eligible for surgical valves.

Global Transcatheter Heart Valve Market, 2013- 2016 (US $M)

The most important attributes of a THI device are the clinical data showing positive results and the ease-of-use. On the other hand, brand loyalty has not been a detrimental factor in device choice. However, the leading reason for choosing a transcatheter heart valve rather than a traditional open heart valve replacement is the speed of patient recovery, as well as better clinical outcomes associated with the use of transcatheter valves. The Placement of Aortic Transcatheter Valves (PARTNER) trial was one of the earliest clinical trials that showed that TAVI was non-inferior to surgery. As a consequence, TAVI was approved by the FDA in 2011. Clinical trials examining new-generation devices are ongoing, and preliminary results have shown the superiority of TAVI in comparison to surgical aortic valve replacement.

The two main competitors in the transcatheter heart valve market are Edwards Lifesciences and Medtronic. The competition between the two companies has led to intense legal battles over patent infringement. Earlier this month, the Federal District Court of Delaware issued an injunction preventing Medtronic from selling its heart valve in the U.S, ruling that Medtronic’s CoreValve infringed Edwards’ patent. Soon after, the U.S. Circuit Court of Appeals subsequently granted Medtronic’s request to postpone implementation of the injunction pending further review. If the injunction eventually takes effect, Edwards Lifesciences will have a near monopoly in the U.S. market.

The high growth seen in this market has attracted interest from major medical device companies such as Boston Scientific and St. Jude Medical. In late 2013, Boston Scientific announced its initial implantation of its Lotus device in Germany. JenaValve Technology is also actively developing a transcatheter heart valve that aims to reduce paravalvular leakage. However, Medtronic and Edwards have benefitted from a first mover advantage, having gained CE mark in 2007, and the European market is already near saturation.

The global market for THVI was well established in 2013 and had a value of over $1.2 billion. New-generation transcatheter aortic valves are currently being clinically evaluated. By addressing the limitations of first-generation devices, including haemorrhagic complications and rhythm disturbances, these devices will be able to meet the growing demand for performing transcatheter valve replacements and expand the addressable patient population. Globally, it is estimated that market growth will exceed 14 percent annually.

Additional Information Is Available

The information contained in this article is taken from three detailed and comprehensive reports published by iData Research (http://www.idataresearch.com/) entitled U.S. Market for Peripheral Vascular Devices , European Markets for Peripheral Vascular Devices, and Global DCB,TAVI, End-User Survey and Analysis 2014. For more information and a free synopsis of the above report, please contact iData Research at: info@idataresearch.com

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental, and pharmaceutical industries. Watch the firm's short company movie at: http://www.idataresearch.net/discoveridata.html