A Comprehensive Guide To The U.S. TAVR Market: Surveying The Field

By Sean Messenger, Decision Resources Group

On April 2, the American College of Cardiology (ACC) annual meeting kicked off with an address from the First Lady of the United States of America. With respect to the Mrs. Obama, hers was only the second-most anticipated presentation of the introductory session. Then again, it’s hard to compete with transcatheter aortic valve replacement (TAVR) these days: One of the biggest medtech success stories of the past decade is about to get even bigger.

A Brief History Of TAVR

Before we get into that, here are four things you need to know:

- TAVR is a relatively new cardiovascular procedure developed to treat patients with severe aortic stenosis (AS)

- AS is a progressive disease generally found in the elderly population, and results in improper blood flow out of the heart and into the rest of the body. Once a patient progresses to the “severe” stage and begins to show symptoms, the prognosis is grim, unless they can undergo an aortic valve replacement (AVR)

- The only method to perform an AVR before TAVR’s introduction was via open surgical techniques (surgical AVR, or SAVR)

- TAVR devices sell for $30,000 each (compared to about $5,000 for a SAVR device)

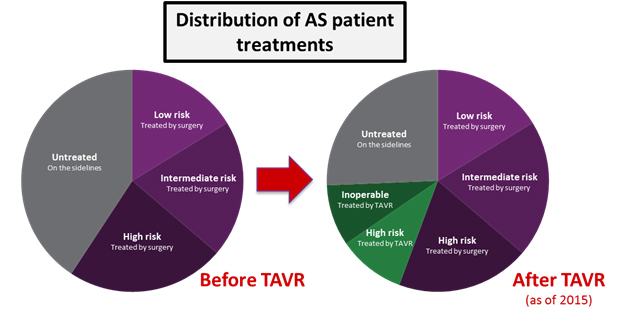

While SAVR is a reliable procedure in younger patients (<80 years old), older patients are often at a high or extreme risk of operative morbidity and mortality, as is generally the case for major open surgical operations. Before TAVR, many of these patients remained “on the sidelines,” in that their severe AS was untreatable through any distinct procedure. The mortality rate for these patients is high: Two years after symptoms present, more than half will die.

The need for an effective treatment in this patient population was both clear and desperate. In 2010, the PARTNER 1B trial showed that TAVR was dramatically superior to medical treatment for this patient population. In fact, TAVR was so superior that it was deemed unethical to conduct further trials in this population that included randomization to any non-TAVR treatment. In 2011, the FDA approved the first TAVR device for commercial use − Edwards Lifesciences’ SAPIEN device. Four years later, in 2015, commercial sales of TAVR had risen to almost $1 billion.

Expanding Indications And A New Kid On The Block

Over the next four years, TAVR as a therapy experienced many other major successes. In 2012, it was approved for the treatment of high surgical risk patients. For the first time, patients that were very risky SAVR candidates had a viable alternative option in TAVR. Patients who had remained “on the sidelines,” either because they could not be treated or did not want to be treated with surgery, started coming off the sidelines. In this way, the availability of TAVR dramatically expanded the treated patient population, rather than cannibalizing other valve replacement procedures.

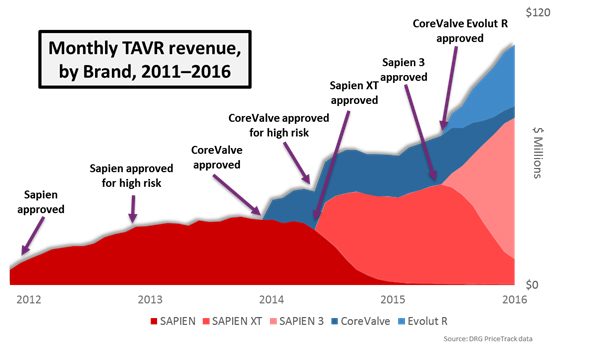

In early 2014, Medtronic’s CoreValve device became the second competitor to enter the market. CoreValve offered a self-expanding alternative to the balloon-expandable SAPIEN platform, and by mid-2014, Medtronic received high-risk approval after CoreValve showed hints of being superior to surgery in the CoreValve High Risk Pivotal Trial.

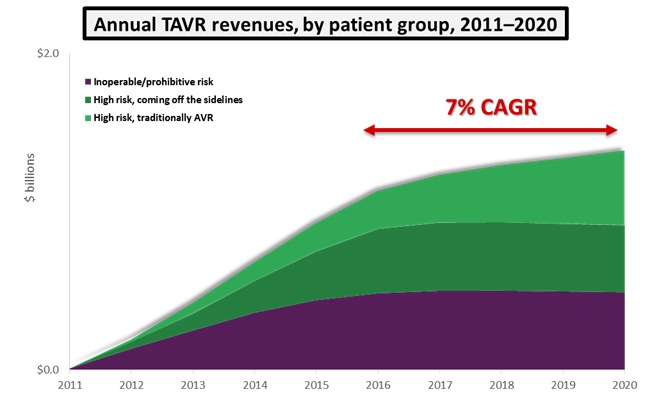

Not to be outdone, Edwards Lifesciences in 2014 received FDA approval for its SAPIEN XT device, which offered a lower delivery profile and more sizing options than previous generations. With this indication approved, the TAVR market expanded rapidly. Over the next five years, if TAVR remains approved only in its current indications, we predict that the U.S. market will grow at a 7 percent compound annual growth rate (CAGR) and reach a value of $1.4 billion by 2020. Some of this growth will be driven by cannibalization of surgical procedures, and the rest will be fueled by inoperable and high-risk patients coming off the sidelines.

While both the CoreValve and SAPIEN platforms were shown to be noninferior to surgery in terms of mortality, three major concerns remained:

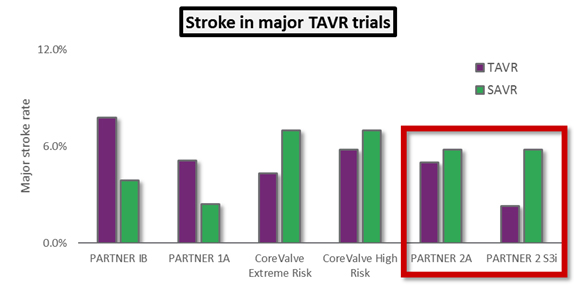

- Patients undergoing TAVR appeared to be at increased risk of stroke — the worst clinical outcome besides mortality.

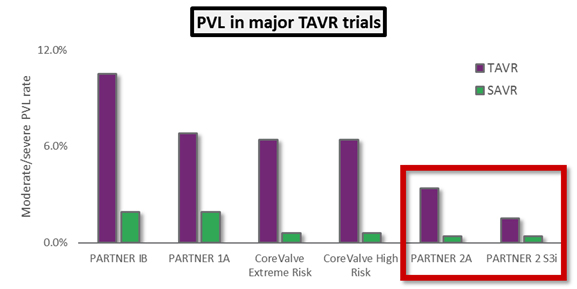

- Moderate or severe paravalvular leak (PVL), associated with high rates of mortality and worse clinical outcomes in general.

- Permanent pacemaker implantation (PPI) was a frequent complication, increasing both procedural cost and long-term complications.

In an effort to address these concerns, Edwards Lifesciences and Medtronic developed the SAPIEN 3 and CoreValve Evolut R devices, respectively, and both devices received FDA approval in June 2015. Still, the high rates of these complications, compared to surgery, was evidence to the medical community that TAVR wasn’t ready to supplant surgery as the gold standard for all patients with severe AS.

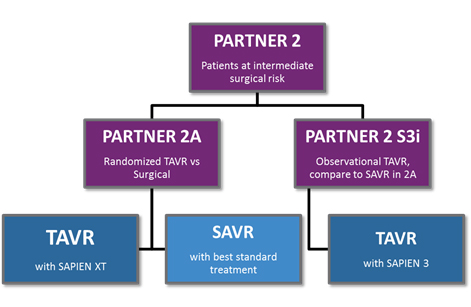

ACC.16: A Turning Point

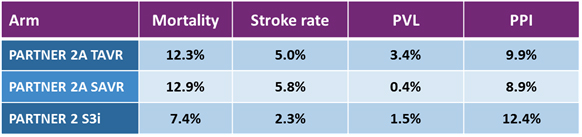

That brings us to the results presented at ACC.16. Previous TAVR trials had shown that the therapy was noninferior, or superior to, standard treatments for inoperable and then high surgical risk candidates. At ACC 2016, final results of the PARTNER 2 trial were presented: PARTNER 2A was a randomized arm of the trial comparing the second-generation SAPIEN XT to surgery in intermediate risk patients, and PARTNER 2 S3i was a propensity matched analysis comparing the third-generation SAPIEN 3 to the surgical arm of PARTNER 2A, also for intermediate risk patients.

The results were positive for TAVR yet again. In PARTNER 2A, the SAPIEN XT arm was noninferior to surgery for the intermediate risk patient population, and results for patients treated with a transfemoral approach for TAVR (as opposed to the less-common transapical approach) actually showed superiority to surgery. The PARTNER 2 S3i study showed unequivocally superior results for SAPIEN 3-treated patients compared to the surgical arm of PARTNER 2A: Not only was the mortality rate superior, but the rate of major stroke was much lower in the SAPIEN 3 arm. Finally, SAPIEN 3 showed the lowest rates of moderate or severe PVL ever seen in a major TAVR trial, approaching the effectiveness of surgery when measured by that outcome.

The key takeaway from these trials is that TAVR now is showing hints that it could one day supplant surgical AVR as the standard of care for all patients with severe AS. If that were to happen, and if prices were to remain the same, the U.S. TAVR market would triple in size to $3 billion annually.

Check back next week for part two of this series, where we will look at what the future holds for the U.S. TAVR market, from major competitors in the space to emerging opportunities.

About The Author

Sean Messenger is a principal analyst on the Medical Device Insights team at Decision Resources Group. In this role, he leads a team of analysts responsible for monitoring and analyzing global cardiovascular device markets through the production of DRG’s Medtech 360 product.

Sean has participated in several speaking engagements, including contributing to a joint Bloomberg-DRG TAVR Roundtable at ACC 2016, leading a conference session at the Life Sciences Forum in Costa Rica entitled “The Next Five Years in the Cardiovascular Device Market,” and speaking at TCT 2013 during a breakfast session entitled “Driving Growth in the World of Transcatheter Cardiovascular Devices.”

Sean holds an Honors BSc from the University of Waterloo, with a specialization in biotechnology and a minor in economics.

Note: Additional information cited in this article was gathered from study results of the PARTNER 1A trial and the CoreValve Extreme Risk trial. All graphics courtesy of Decision Resources Group.